Social Media Spotlight: 01/28/2022

Twice a month, we like to send along an easygoing post with compelling “SoMe” content. Consider this Rate of Return’s ‘kick back and check out this interesting stuff’ email.

Keeping it to just macro topics this week. Let’s jump in!

Reminder:

ARK Invest’s CEO and Chief Investment Officer, Cathie Wood, is hosting a Town Hall on Public.com’s app this Monday (2/1) at 12p ET. With ARK Invest facing significant criticism lately, I’ll certainly be asking her about current market conditions and the projected growth of her favorite stocks.

I’m pretty sure the only way you can ask her a question is from within the Public App — which you can download / access here.

Fresh from @ARKInvest's Big Ideas Summit, @CathieDWood joins us for our next investor Town Hall.

— Public.com (@public) January 26, 2022

Open the app now to submit your questions. Cathie will be answering them live on Feb. 1 at 12 PM ET.https://t.co/QKlRdflTc8

Topics Include:

-

The Market Meltdown

-

Crazy Charts & Stats

The Market Meltdown

This is your friendly reminder that no market, especially the US stock market, moves up in a straight line without falling along the way. Over the last few weeks I’ve gotten messages from folks calling out certain stocks I’ve invested in as “losers” — when those same stocks rose 60-150% in a matter of 6 months.

Always have your risk tolerance in check and always be considerate of when you plan to take profits!

🇺🇸 All U.S. Listed Companies on the Opening Bell pic.twitter.com/x2y7Y4kCko

— PiQ (@PriapusIQ) January 25, 2022

The next tweet is not to say that the S&P Price-to-Sales ratio will drop another 20%, especially considering inflationary pressures help keep this high. It’s more of a red flag that we should keep an eye on.

The good news is, stocks are getting cheaper. Price/Sales of the S&P 500 is now just 20% above the dot-com level. pic.twitter.com/TNRDH44ARs

— Oliver Renick (@OJRenick) January 24, 2022

I’ve talked about Warren Buffett plenty of times before, and that’s because he’s one of the greatest investors of all time. One of his leading indicators for the future success of America is household formation.

With surging prices in homes, mass relocations from big cities, and inflation impacting the purchase power of buyers — the single family household shortage continues to soar. This is the reason we follow economic data (especially housing) so closely in the Week in Review posts — they matter.

I’ll be paying close attention to Buffett’s action this year and will relay it to you all.

The housing boom continues with US Home Prices hitting all-time highs again, up 19% over the past year. Home prices in the US have more than doubled since 2012. pic.twitter.com/WaTefuS8Rt

— Charlie Bilello (@charliebilello) January 25, 2022

crazy chart

— Tanay Jaipuria (@tanayj) January 23, 2022

(via https://t.co/iV9v5yaFm6) pic.twitter.com/FT45gn6JyO

Any way you slice it, the post below means one word — capitulation. Does that mean it’s the end of all the pain? I wouldn’t say that, but I would say that the trading volume on Monday (1/24) was very much a “changing of the guard” moment from bulls to bears. Volatility should be around for awhile.

Holy moly, $SPY traded over $100b worth of shares for only second time ever (3/2/2020 was other time), which is more than top 4 stocks combined. And $QQQ smashed its record with $66b (set Fri lol). If you combine the two, they did $170b, which is all time record, here's chart: pic.twitter.com/4QfhFeAkVx

— Eric Balchunas (@EricBalchunas) January 24, 2022

Crazy Charts & Stats

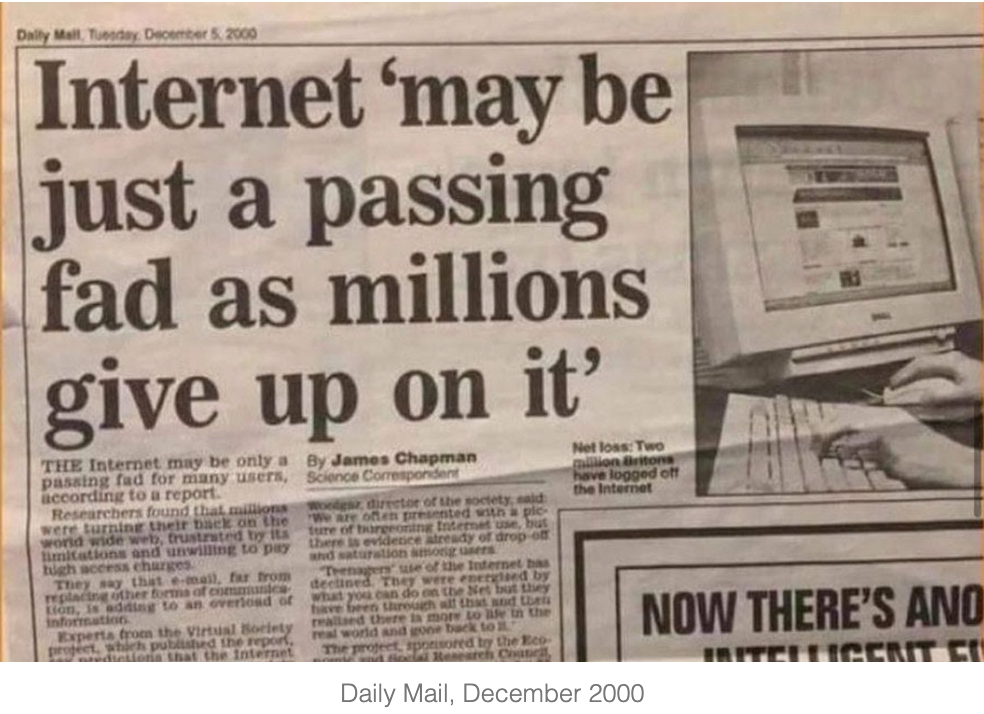

Comparisons like the one below have been made for the last few years, so I won’t harp on it too much. It’s just easy to forget that while history may not always repeat itself, it sure does rhyme. Still long BTC, ETH, and LINK.

Crypto adoption = 90's Internet adoption pic.twitter.com/bqnBwTaq6k

— Blockworks (@Blockworks_) January 23, 2022

Love listening to anything Sima Gandhi, CEO of Creative Juice, has to say about the creator economy.

Hot diggity. GO GO creator economy

— sima gandhi (@simagoo) January 25, 2022

– The # of YT channels making $10K/year is up 40% YoY

– In 2020, YouTube's economy supported more than 800,000 jobs

– Channel Membership and digital goods were purchased or renewed 110M times in 2021

– Viewership on YouTube Shorts passed 5T

If you’re well-versed on Chainlink and know what the company is capable of… the second chart in the post below should make you very excited. I wrote this post about Chainlink, with helpful resources to learn more. The price has taken a beating since soaring to start the year, but my long-term confidence in this company and project remains unwavering.

Just a reminder that one of the major goals of @chainlink is to seamlessly connect existing off-chain enterprise backend systems to smart contracts on _any_ blockchain. This is one of their major confirmed agendas for 2022.

— 🔰 Linkie 2.0 #CCIP (@ChainlinkoracIe) January 24, 2022

Fuck short-term PA. Patience will be rewarded.$link pic.twitter.com/ORm718Tlfw

After yet another beautiful Apple earnings report this week, be on the lookout for dips in the stock price during these turbulent times. I most definitely plan to increase my position if the opportunity presents itself.

Apple has enough cash on hand ($190B) to buy Netflix ($169B) and Peloton ($8B), with money left over to give every American $1m 🤯

— Trung Phan 🇨🇦 (@TrungTPhan) January 21, 2022

The NFL Playoffs have been CRAZY. The post below was for Wild Card Weekend, so the biggest names playing that day obviously received more searches than teams like the Chiefs or Titans — who had first round byes.

I surface this tweet not because of the graphic itself, but more encouraging you to pay attention to Google Trends. Our friend, Chris Camillo, has proven that they can be extremely valuable in your investing journey. Maybe next year for my beloved Titans.

The #NFLPlayoffs begin tomorrow with the #WildCardWeekend games. Here's how each of the 14 playoff teams have done in Search over the past week.

— GoogleTrends (@GoogleTrends) January 14, 2022

Who do you have getting to the #SuperBowl this year? 🏈 #NFLTwitter pic.twitter.com/bgxHSrUipD

I don’t know about you, but I’ve always found the ‘pay me in bitcoin’ crowd to be a bit much. I love the long-term conviction being expressed by athletes like Aaron Rodgers, Trevor Lawrence, Saquon Barkley, and Odell Beckham Jr. (below).

I just wouldn’t recommend receiving your salary in a historically volatile asset and encouraging others to do the same.

The amount of people applauding players changing their salary into Bitcoin as if they were heroes has been comical.

— Darren Rovell (@darrenrovell) January 23, 2022

Rams WR Odell Beckham Jr., at least in the moment, provides a cautionary tale. pic.twitter.com/uW0QDdJrYy

With a tagline of “murder your thirst” and selling 16.9oz “tallboy” cans of water… I just found this one simply too insane not to share. Branding pays.

If anyone tells you branding isn't important, remind them that Liquid Death has now raised $125 million altogether and is valued by its backers at $525 million.

— Saba Karim (@sabakarimm) January 26, 2022

Liquid Death is just "canned water".

Have a great start to your weekend!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Inclusions of Social Media Spotlights don’t necessarily receive our full ‘endorsement’ or complete analytical review.